- Solar Energy Technologies Office

- Solar Energy Resources

- Solar Energy for Consumers

- Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics

This webpage was updated April 2024.

View this webpage in Spanish. Vea esta página web en Español.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics (PV). (See the Federal Solar Tax Credits for Businesses for information for businesses). It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. Please see their published Fact Sheet for additional information. The below guide should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

Photo courtesy of Dennis Schroeder, National Renewable Energy Laboratory.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What is the federal solar tax credit?

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

The installation of the system must be complete during the tax year.

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032. (Systems installed on or before December 31, 2019 were also eligible for a 30% tax credit.) It will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it.

There is no maximum amount that can be claimed.

Am I eligible to claim the federal solar tax credit?

You might be eligible for this tax credit if you meet the following criteria:

- Your solar PV system was installed between January 1, 2017, and December 31, 2034.

- The solar PV system is located at a residence of yours in the United States.

- Either:

- You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing the system nor nor paying a solar company to purchase the electricity generated by the system).

- Or, you purchased an interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption. Notes: the IRS issued a statement (see link above) allowing a particular taxpayer to claim a tax credit for purchasing an interest in an off-site community solar project. However, this document, known as a private letter ruling or PLR, may not be relied on as precedent by other taxpayers. Also, you would not qualify if you only purchase the electricity from a community solar project.

- The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

What expenses are included?

The following expenses are included:

- Solar PV panels or PV cells (including those used to power an attic fan, but not the fan itself)

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

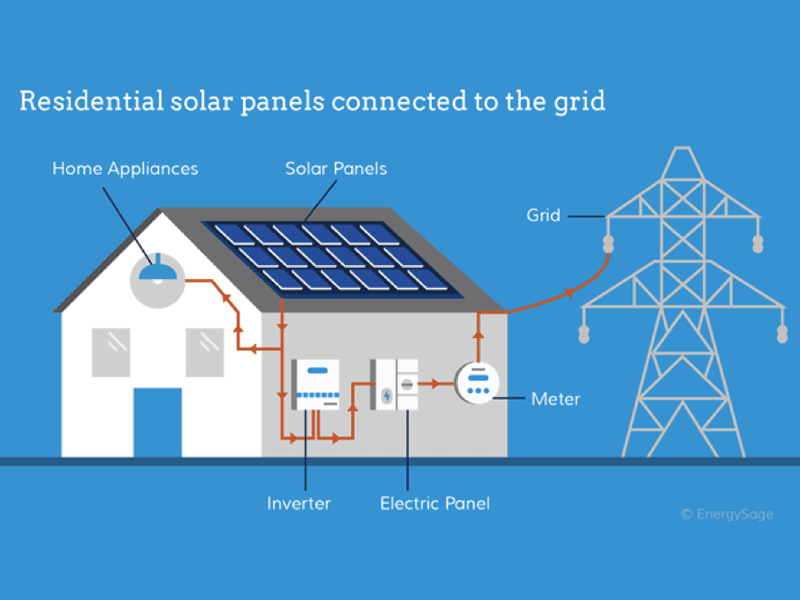

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that have a capacity rating of 3 kilowatt-hours (kWh) or greater (for systems installed after December 31, 2022). If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to the installation date requirements). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

- Sales taxes on eligible expenses

How do other incentives I receive affect the federal tax credit?

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

($18,000 – $1,000) * 0.30 = $5,100

However, payments from a public utility to compensate for excess generated electricity not consumed by the taxpayer but delivered to the utility’s electrical grid (for example, net metering credits) are not subsidies for installing qualifying property and do not affect the taxpayer’s credit qualification or amounts.

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated (either upfront or over time), the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Rebate from My State Government

Unlike utility rebates, rebates from state governments generally do not reduce your federal tax credit. For example, if your solar PV system was installed in 2022, installation costs totaled $18,000, and your state government gave you a one-time rebate of $1,000 for installing the system, your federal tax credit would be calculated as follows:

$18,000 * 0.30 = $5,400

State Tax Credit

State tax credits for installing solar PV generally do not reduce federal tax credits—and vice versa. However, when you receive a state tax credit, the taxable income you report on your federal taxes may be higher than it otherwise would have been because you now have less state income tax to deduct. (The Tax Cuts and Jobs Act of 2017 placed a $10,000 limit on state and local tax (SALT) deduction through 2025. Therefore, if a homeowner is still paying more than $10,000 in SALT after claiming a state tax credit, the state tax credit benefit would not effectively be reduced by the federal tax rate, as it would not impact federal taxes (due to the SALT limit).) The end result of claiming a state tax credit is that the amount of the state tax credit is effectively taxed at the federal tax level.

Can I claim the credit, assuming I meet all requirements, if:

I am not the home owner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D(d), which specifies that eligible solar electric property expenditures must be “for use at a dwelling unit located in the United States and used as a residence by the taxpayer” (emphasis added).

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence

The solar PV panels are on my property but not on my roof?

Yes. The solar PV panels located on your property do not necessarily have to be installed on your roof, as long as they generate electricity for use at your residence.

I have a home office (or my residence is also used for a commercial purpose)?

Yes, but if the residence where you install a solar PV system serves multiple purposes (e.g., you have a home office or your business is located in the same building), claiming the tax credit can be more complicated. When the amount spent on the solar PV system is predominantly used for residential rather than business purposes, the residential credit may be claimed in full without added complications. However, if less than 80% of the solar PV system cost is a residential expense, only the percentage that is residential spending can be used to calculate the federal solar tax credit for the individual’s tax return; the portion that is a business expense could be eligible for a similar commercial ITC on the business’s tax return.

I financed my solar PV system instead of paying for it upfront?

Yes. If you financed the system through the seller of the system and you are contractually obligated to pay the full cost of the system, you can claim the federal solar tax credit based on the full cost of the system. Miscellaneous expenses, including interest owed on financing, origination fees, and extended warranty expenses are not eligible expenses when calculating your tax credit.

I bought solar panels but have not installed them yet?

No. The tax credit is only for systems for which installation was complete during the year.

I participate in an off-site community solar program?

The answer depends heavily on your specific circumstances. The IRS states in Questions 25 and 26 in its Q&A on Tax Credits that off-site solar panels or solar panels that are not directly on the taxpayer’s home could still qualify for the residential federal solar tax credit under some circumstances. However, community solar programs can be structured in various ways, and even if you are eligible for the tax credit, it may be difficult to claim due to other tax rules.

For example, one arrangement is the creation of a “special purpose entity,” where community members form and invest in a business that operates the community solar project. If your participation is limited to investing in the community solar project and you do not participate in the operation of the project on a regular, continuous, and substantial basis, you are constrained in taking advantage of the credit because you are considered a “passive investor.” IRS rules require that a tax credit associated with a passive investment only be used against passive income tax liability, which only applies to income generated from either a rental activity or a business in which the individual does not materially participate. Many homeowners will therefore not have passive income against which the credit can be claimed.

FAQ's Cont.

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayer’s total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Is there a dollar or lifetime limit on the federal solar tax credit?

No, there is neither a dollar limit nor is there a lifetime limit on the tax credit. The credit is only limited to 30% of qualified expenditures made for property placed in service in a given year.

Can I qualify for the tax credit if the property installed has been used by another individual?

No. Used property is not eligible for the federal solar tax credit.

Is the cost of a roof replacement eligible for a tax credit?

Sometimes. Traditional roof materials and structural components that serve only a roofing or structural function do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve both the functions of solar electric generation and structural support and such items may qualify for the credit. This may change based on additional guidance from the Treasury Department.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming the builder did not claim the tax credit)—in other words, you may claim the credit in 2023. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

What about these bonuses I’ve heard about? Am I eligible?

In general, no. You may have heard about several bonuses or “adders” available for the federal solar tax credits, namely the low-income communities bonus, energy community bonus, or the domestic content bonus. These bonuses are available for businesses, but they are not available for homeowners filing for the credit. That being said, there are several ways in which you could still benefit from these bonuses. These include: leasing the solar system installed on your home from a business that can qualify for one or all of these bonuses and pass that value on to you; or, if the electricity from the solar system is primarily used for business purposes like a home-office or powering farm equipment, it can be claimed as part of your business’s tax filings. If you think one of these situations may apply to you, please see Federal Solar Tax Credits for Businesses for more information and speak to a tax professional.

How do I claim the federal solar tax credit?

After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR). Instructions on filling out the form are available here.

Where can I find more information?

Ask Questions

Internal Revenue Service (IRS), 1111 Constitution Avenue, N.W., Washington, D.C. 20224, (800) 829-1040.

Find Resources

- View SETO’s other federal solar tax credit resources.

- The federal statute and IRS guidance: 26 USC § 25D at www.gpo.gov and “Q&A on Tax Credits for Sections 25C and 25D” at www.irs.gov.

- Updated information on the current status of the ITC: Database of State Incentives for Renewables and Efficiency entry on “Residential Renewable Energy Tax Credit” at www.dsireusa.org.

- The U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) held a webinar on September 27, 2022, to discuss the recent policy changes in the Inflation Reduction Act. Watch the recording, download the slides, and read the Q&A.

- Download a PDF version of this webpage: Guide to Federal Tax Credit for Residential Solar Photovoltaics.

- Read the Homeowner’s Guide to Going Solar.

Green Power Utah

At Green Power Utah we can help you get your solar installed and get you the lowest prices in the state. We’ll show you what your costs look like with the tax credits included. Don’t overspend on solar, we’ll help you get the price you deserve. With the prices steadily going up on your power bill, now is the best time to get solar. Take advantage of these tax incentives on solar, while they are here, don’t wait too long, they may go away in early 2025. Call us today for a free estimate on your home.

Soure:

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics